unlevered free cash flow vs fcff

FCFF is known as unlevered free cash flow while EFCF is known as levered free cash flow. Free cash flow to firm FCFF is a portion of a companys cash that could be distributed without affecting its operations.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

We divide the taxes by the operating income which equals.

. The look thru rule gave qualifying US. You might also hear unlevered free cash flow UFCF referenced as free cash flow to firm FCFF. FCFF is not levered on.

Unlevered cash flow is the free cash flow available to a company net of any interest payments. Unlevered free cash flow is visible to investors equity holders and debtholders in the company. Unlevered FCF is FCF to the enterprise ie the firm.

What Does Unlevered Mean. Okay now lets determine what the levered cash flow for Intel is for year-end 2020. The cash a company has to pay all its stakeholders equity holders and debt holders is the unlevered cash flow.

FFCF is the net amount left after repaying the debts to creditors and investors along with a given return. Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. FCFF 23876 1-1705 12239 14453 1778 15813 millions.

That is fairly straightforward once we know where to get the inputs. The term levered refers to leverage which is essentially debt. A complex provision defined in section 954c6 of the US.

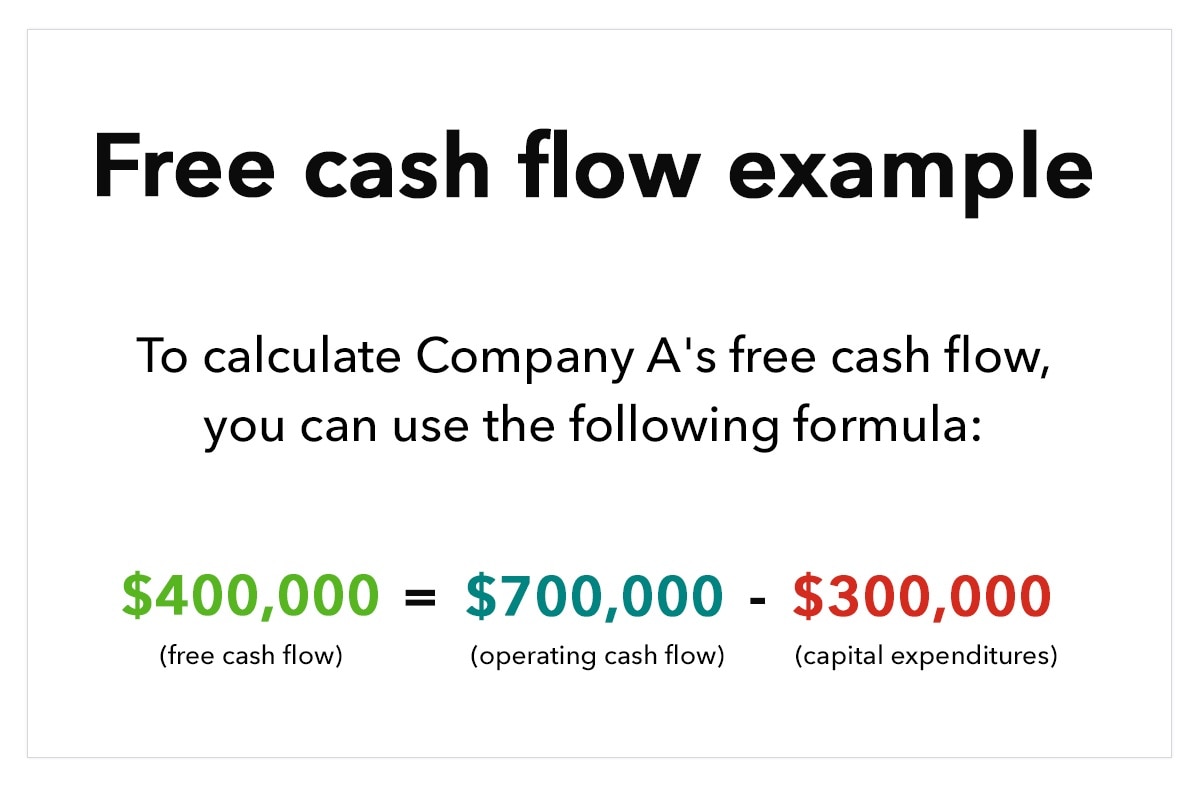

Free cash flow is the cash that a company generates from its business operations after subtracting capital. When performing business calculations unlevered is a term that describes money that is available before financial obligations are met. Internal Revenue Code that lowered taxes for many US.

Also the levered cash flow is net of a companys. Free Cash Flow to the Firm is called unlevered because it is independent of debt and interest payments. Components of FCFF Formula- Adjustments from EBIT to FCFF a.

FCFFEBIT 1-tax rateNon-cash expenses-Capital Expenditure-Change in working capital. FCFF provides important insights into the value and health of a company. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account.

Tax rate 4179 23876 1705. Free cash flow to the firm is synonymous with unlevered free cash flow. Unlevered free cash flow can be reported in a companys.

Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a firm after expenses. FCFF is not the same as CFO - CAPEX because Cash from operations starts with net income instead of NOPAT where NOPAT net operating profit after taxes is EBIT 1 - t. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

Free Cash Flow to the Firm FCFF How to calculate FCFF EBIT to FCFF formula with components calculation of FCFF with example Net Working Capital. Free Cash Flow For The Firm - FCFF. Unlevered Free Cash Flow - UFCF.

If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. Why is FCFF called Unlevered FCF. If the company is not paying dividends.

Analysts like to use free cash flow either FCFF or FCFE as the return. Operating cash flow measures cash generated by a companys business operations. The difference between levered and unlevered FCF is that levered free cash flow LFCF subtracts debt and interest from total cash whereas unlevered free cash flow UFCF leaves it in such that LFCF Net Profit DA ΔNWC CAPEX Debt and UFCF.

19th Ave New York NY 95822 USA.

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Calculator

How To Calculate Free Cash Flow Excel Examples

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

What Is Free Cash Flow And Why Is It Important Quickbooks

Fcf Formula Formula For Free Cash Flow Examples And Guide

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Unlevered Free Cash Flow Definition Examples Formula

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow To Firm Fcff And Free

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

What Is The Difference Between Free Cash Flow To Equity And Free Cash Flow To Firm Quora

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-03-2c4a6ea86c4b4b13b8a440cee78fac7d.jpg)